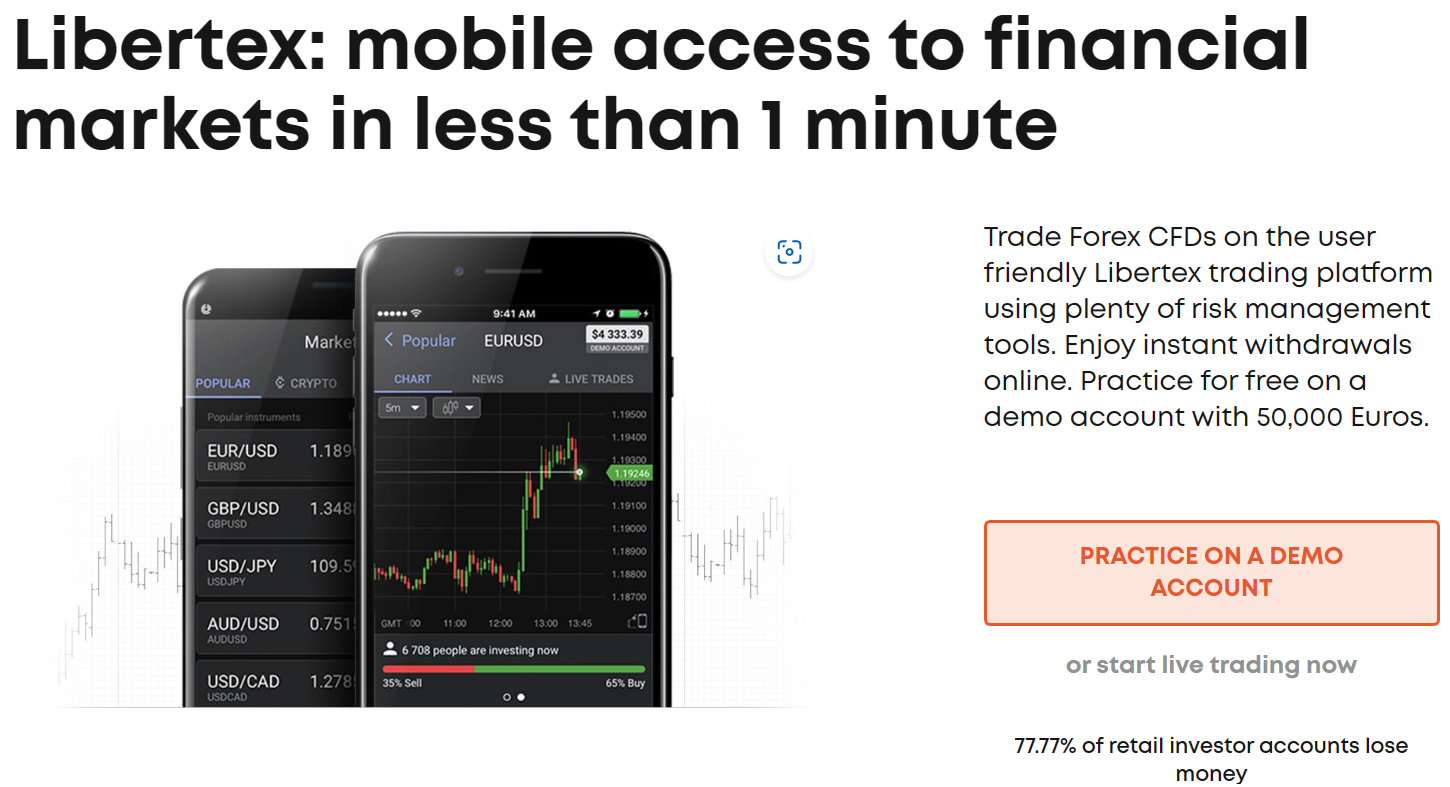

Work with Libertex DEMO

Trading with a demo account

How to Fund your real Libertex Account

What you should know before trading with Libertex

What is Leverage?

What is the price of the trades in the Libertex Terminal?

Trading with a demo account

Your demo account is a training version of your live account where you can trade with real underlying assets without risking your own money.

What are the advantages of a demo account?

– You are training on the same online terminal, where the live trade also takes place.

– There all underlyng assets for you to practice trading.

How to open a demo account:

– Click on “Register an account”

– Complete the simple form (you must be 18 years or older).

– Log in to your Libertex account and train at any time.

How to Fund your real Libertex account

1. Log in with your user name and password at Libertex. If you do not already have an account, simply open one.

2. Click “Deposit to your account”. If you haven’t completed your onboatding questionaire, you need to do it otherwise you will not be able to fund your account.

3. Choose Deposit method and enter the amount. Then click on «To pay».

4. Depending on your bank, it may be necessary to confirm your payment again.

5. Done! You will be notified of the result of the operation.

What you should know before trading with Libertex

To practice trading CFDs:

– Open an account at Libertex (1-2 minutes)

– Log in to the Libertex web terminal or download the mobile app from Libertex

Select “Demo Account”

– Select an underlying asset (e.g. CFD EUR/USD) which you want to practice trading and click on “Open trade”

– Specify the trade amount the value of the multiplier is set by default

– Set the profit and loss limits (if desired)

– Select the direction (BUY = price goes up or SELL = price goes down) and your trade is ready.

What is Leverage?

Leverage is the ratio between the volumes being traded, i.e. the total trading amount with the multiplier applied, and the used margin amount.

What is the maximum leverage for each asset class for retail clients?

a. 30:1 for major currency pairs

b. 20:1 for minor currency pairs, gold, and major indices

c. 10:1 for commodities other than gold and minor indices

d. 5:1 for individual equities and other reference values

e. 2:1 for cryptocurrencies

How will this affect my trading account with Libertex?

When you trade any underlying asset, the leverage applied depends on the class such an asset belongs to.

With higher leverage, you need less funds (margin) to open a position, which allows you to open big trades while investing less funds.

Conversely, if the leverage is low, you will need more own funds to open your position.

But keep in mind that the risk of losses grows as well.

How do I know the total amount of the trades I can open when my account balance is N?

Maximum Amount = Free Margin * Max Leverage for the asset class in question

Example 1.

Let’s assume now your account balance is again €10,000, but you want to open multiple trades on EUR/USD CFD .

This is a major currency pair, so the maximum leverage here is 30:1.

Thus, your maximum overall trade amount with multiplier applied is 10,000*30=€300,000.

So, you are free to open any number of EUR/USD trades you want, but their total value, including the multiplier, must not exceed €300,000.

Example 2

Let’s assume your account balance is again €10,000, and you want to open multiple trades on gold CFDs.

For CFDs on minor currency pairs, gold, and major indices the maximum leverage is 20:1.

Thus, your maximum overall trade amount with multiplier applied is 10,000*20=€200,000.

What is the commission on the trades in the Libertex trading platform?

Trades in the Libertex trading platform are really competitive, they start at 0.0003% per trade. You may find more detailed info in the specification section on the broker’s website.

START NEW

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.91% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.